Featured

- Get link

- X

- Other Apps

AN APPLICATION OF THE CAPITAL ASSET PRICING MODEL - Example paper from UMGC

This article was originally the answers to a UMGC FIN 610 course. I'm sharing it here in hopes that someone finds it helpful. Don't be a dummy though, Turn-It In exists.

Question One - What number should he use for the “risk-free rate”?

Michael Anderson should use 2.3% which is the yield of the 10-year Treasury bond as the risk-free rate. The rationale behind the choice is based on Damodaran’s (1999) definition of the optimal risk-free asset. First, the asset must have no default risk which is true for the 10-year treasury bond since it is a government security. The second factor is that the asset should not have a reinvestment risk. Reinvestment risk refers to the phenomenon where an investor is unable to reinvest cash flows at the same rate of return as previous cashflows. As such, to reduce reinvestment risk, the optimal risk-free asset should have the same duration as the security under concern which in this case is the shares of the Green World company. The investment in Green World company is expected to generate good returns in coming years rather than the current time. Since the investment horizon is not explicitly stated, Michael Anderson should assume a long investment horizon and use the 10-year treasury bond which also has a long duration.

Question Two - Should he use any of the estimates for the expected market return (Yahoo’s, MSN’s,or Google’s), or should he take the average of those estimates as his best estimate forexpected market return?

Yahoo! Finance, MSN Money, and Google finance are all reputable financial websites thus their estimates for expected stock market returns are probable. In this case, Michael should investigate the stock index used by the three websites to estimate the expected market returns. In doing so, he would discover which companies make up the index and consequently choose the estimate based on the most appropriate index for the Green World company. Alternatively, he should average the three expected returns to determine next year’s expected market return. In that case, the expected return for the stock market is 11%.

Question Three - Should he use any of the beta estimates (Yahoo’s, Google’s, or NASDAQ’s), or should he take the average of those estimates as his best estimate for “Green World” shares’ beta?

In the case of beta, Michael must first determine the estimation basis for the betas computed by Yahoo! Finance, NASDAQ, and Google finance. A difference in the estimation basis with regards to returns i.e., daily returns, weekly returns, monthly returns, or even annual returns may explain the disparity observed between the three beta estimates. The difference in betas is significant in this case because a beta of less than one implies that the Green world’s shares are less volatile than the market but a beta of more than implies that they are more volatile than the market. Yahoo! Finance’s and Google finance’s are very similar and both indicate that the company’s shares are less volatile than the market while NASDAQ indicates that the company’s shares are more volatile than the market. In my opinion, the best alternative, in this case, is to average Yahoo! Finance’s and Google’s beta since they seem to have a similar estimation basis. As such, Green World’s beta is 0.84.

Question Four - He wants to draw the Security Market Line (i.e. SML). How can he do that? How will the SML look like?

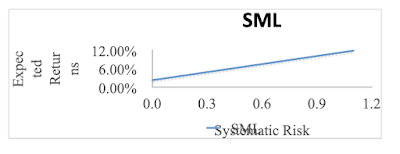

Michael Anderson can draw the Security Market Line (SML) by plotting the independent variable i.e., beta on the X-axis and the dependent variable i.e., expected stock return on the Y-axis. The expected stock return can be computed using the Capital Asset Pricing Model (CAPM) with 2.3% which was previously determined as the risk-free rate. Given the determined beta of 0.84, the beta values on the X-axis should be inclusive of this value. The expected market return that should be used for CAPM is the 11% determined in question two. Given that, the slope of the SML represents the market risk premium and the SML is a straight line that should intercept the Y-axis at the risk-free rate as shown in the graph below.

From the graph, the SML has an intercept of 2.3% which is the risk-free rate, and a slope of 8.7% which is the market risk premium. The market risk premium can be confirmed by deducting the risk-free rate (2.3%) from the expected market return (11%) which also gives 8.7%.

Question Five - If a stock’s expected return falls exactly on the SML, according to CAPM, is the stock fairly priced, overpriced, or underpriced?

If a stock’s returns fall exactly on the SML, the stock is fairly priced. The rationale behind this is that the stock’s expected returns are similar to the returns of similarly risky stocks.

Question Six - If a stock’s expected return is more than what the SML indicates (i.e. above the SML), is the stock fairly priced, overpriced, or underpriced?

If the expected returns of a stock are more than the SML, the stock is under-priced. The reasoning behind this is that the returns of the stock are more than those of similarly risky stocks.

Question Seven - Think about the SML in question #4. If the expected return on “Green World” shares is 13% and beta of “Green World” is 0.9, is “Green World” stock fairly priced, overpriced, or underpriced according to CAPM? In this case, should Michael invest in “Green World” shares?

The equation for the SML as graphically represented in question four is as follows:

y = 0.087x + 0.023

Thus, given a beta of 0.9, the corresponding expected return on the SML should be:

10.13% = 0.097 X 0.9 + 0.023

Given that, it is clear to note that Green World’s 13% expected return is higher than 10.13% which means that its returns are above the SML. This suggests that the company’s stocks are under-priced since their returns are several points higher than the returns of similarly risky assets. Under such a scenario, Michael Anderson should purchase Green World stocks.

Question Eight - There is another company that deals with sustainability projects. This company’s name is “Global Unity”. If “Green World” and “Global Unity” stocks both have the same reward to risk ratio (i.e. they are on the same SML) and if the beta of “Global Unity” is 1.3, what is the expected return on “Global Unity” stock? Please use the expected return and beta of “Green World” stock that are given in question #7.

13.61% = 0.087 X 1.3 + 0.023

In consideration of the SML, the expected return given a systematic risk of 1.3 is 13.61%. In comparison to Green World’s return of 13% as mentioned in question 7 above, Global Unity’s return is slightly higher. However, comparing the risk factors of Green World and Global Unity, Global Unity is way riskier than its counterpart. Given that Global Unity’s returns are on the SML, it is correct to conclude that the firm’s stock is fairly priced. Thus, my choice between Green World and Global Unity’s stock is baised for Green World. This is is because the company is under-priced as previously discussed thus it allows an investor to enjoy a high return without assuming the appropriate risk for said return. In a choice between Green World stocks and Global Unity stocks, Michael Anderson should purchase Green World stocks.

Question Nine - In general, if the SML gets steeper (the reward to risk ratio gets higher), is it good for the firms who wants to get financing?

It is not good for firms who want financing if the SML gets steeper. As previously mentioned, the slope of the SML is the market risk premium thus a steep SML implies a high market risk premium which is defined as the difference between the expected market returns and the risk-free rate. Provided that all other factors are kept constant, an increase in the market risk premium translates to an increase in the expected stock return and vice versus under CAPM. The implication of this is that investors would demand a higher return from companies which means that firms would incur a higher cost of financing than if the market risk premium was lower. In such a case, a firm may opt to explore other means of financing like debt financing.

The questions come from An Application of the Capital Asset Pricing Model by Halil D. Kaya, found in the International Research Journal of Applied Finance ISSN 2229 – 6891 Vol. VII Issue – 8 August, 2016 Case Study Series.

References

Damodaran, A. (1999). Estimating risk free rates. WP, Stern School of Business, New York.

Popular Posts

20 (Unique) Gift Ideas for People with No Hobbies

- Get link

- X

- Other Apps

The 10 Best DIY Gift Kits for Hard to Shop For Men - Multiple Price Points

- Get link

- X

- Other Apps

Comments

Post a Comment